3 min read

Bon Voyage to the Ordinary: Top Ecommerce Trends for Travel Brands in 2024

The travel industry is taking flight in the digital realm. As wanderlust reigns supreme, travel brands need to equip themselves with...

The automotive industry is always changing, with fierce competition from manufacturers to keep sales consistent – especially during COVID-19. To keep an eye on market fluctuations and emerging trends, we are constantly tracking automotive search data. We’ve compiled this into a 2020 Q3 update, to keep you informed about the latest automotive search statistics.

As we can see in the video, the period from 2010 to around 2015 shows a great deal of steady growth, with the number of new car registrations climbing each year. However, in 2016 we see the beginning of a steady decline for the next few years. We don’t know if this trend would have continued, though, as 2019-2020 saw a sudden, rapid fall in new car registrations – possibly due firstly to Brexit uncertainty and then to COVID-19, as the industry ground to somewhat of a halt. It will be interesting to see what happens over the next six months, and find out how effectively the automotive industry recovers after the end of lockdown.

New registrations by year since 2010 for all manufacturers in the UK (SMMT Data).

The top 5 manufacturers by new cars regs are:

Compared to 2011:

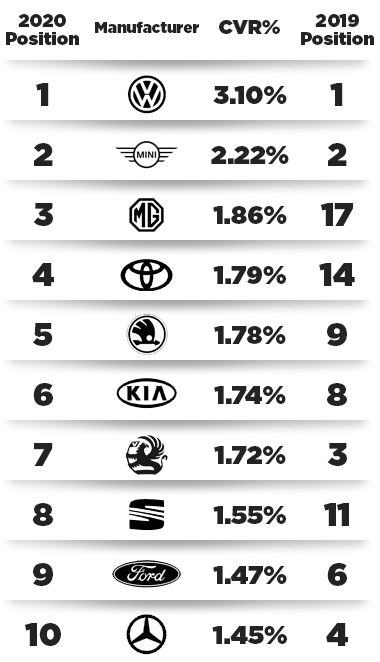

We analysed Google searches for new cars by the manufacturer in 2019 and 2020 and correlated the results with the number of vehicles registered by each brand to produce an industry conversion rate.

With COVID-19 this year’s (YTD) table is a little more interesting, along with some strong sales from less popular manufacturers.

In general, the conversion rate from last year is down by 44% as an industry, with the poorest YoY performers coming from Smart, Subaru and Land Rover.

The industry average conversion rate for 2019 was: 2.14%

The industry average conversion rate for 2020 is: 1.17%

Lexus and Suzuki are the only manufacturers not to see a decrease in a conversion rate of over -10%.

Currently, we’re seeing a V-shape trend from our automotive clients with June being a strong performer for dealerships as we emerge from lockdown.

With a lot of new popular models coming out by the end of the year, such as the Audi A3, new BMW 4 series and SEAT Leon, in our Q4 update, we may see this table change quite a lot.

That’s it for this update, but keep your eyes peeled for more automotive insights from us. We’ll be putting out these updates every six months, so stay tuned to see how much has changed in the automotive industry.

3 min read

The travel industry is taking flight in the digital realm. As wanderlust reigns supreme, travel brands need to equip themselves with...

2 min read

The fashion scene is undergoing a digital makeover. With consumer habits constantly shifting, fashion brands need to adapt and embrace innovative...

2 min read

The home and garden landscape is blooming in digital. As consumer preferences evolve, home and garden businesses need to cultivate innovative...